We asked more than 300 people how debt impacts their financial situation and their lives. How does debt impact a person’s stress level? Does the type of debt impact someone’s money worries? Do people understand what healthy and unhealthy debt is?

Here are the highlights:

- Americans who have more than 1 type of debt are more likely to be stressed out or overwhelmed.

- Most credit card users are disappointed with the amount of their current debt.

- Nearly 3/5 (57.7%) of Americans, believe their debt situation is better than their friends or family.

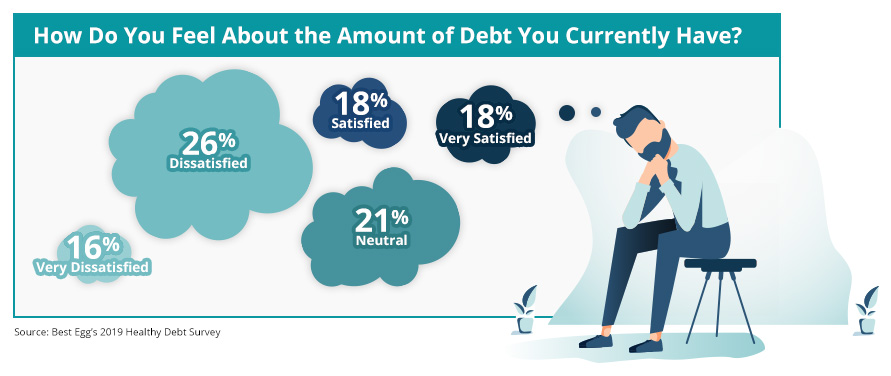

Americans are unsatisfied by the sheer amount of debt they have

While a majority of respondents feel they have control of their debt, they’re generally unhappy with how much they have. When we cut the data by income and credit score, people with higher income and credit scores generally feel better than people with lower income, or fair and poor credit scores.

More Debt = More Stress

Americans who have several types of debt report they are more stressed about it, compared to respondents who only carry 1 type of debt.

Read more: 10 Strategies to Alleviate Financial Stress | Best Egg

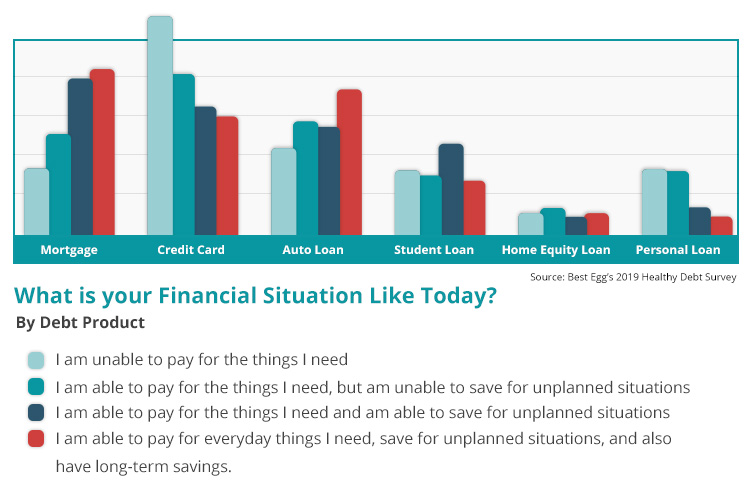

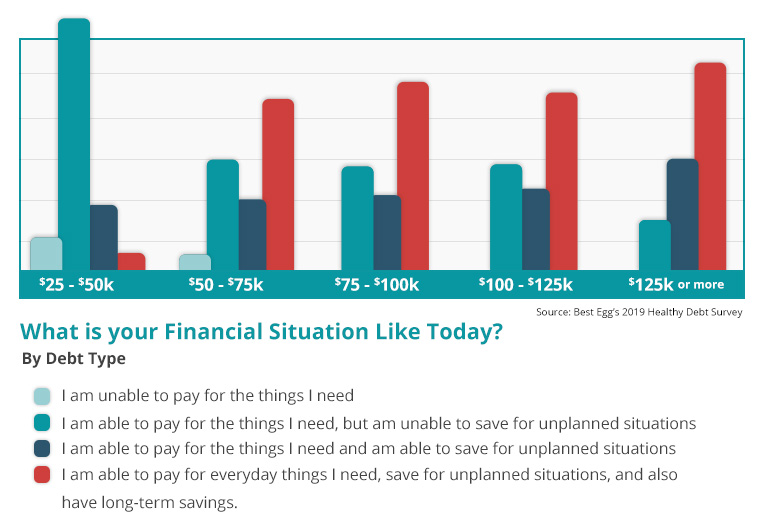

Saving for unplanned situations

While a majority of Americans report they can pay for the things they need, have a long-term savings, and can save for unexpected expenses, credit card holders are less likely to have the ability to save for unexpected expenses, like health emergencies or unplanned repairs.

The key to financial confidence is to have a plan and strategize on your spendings.

Read more: Tips for Mindful Spending | Best Egg

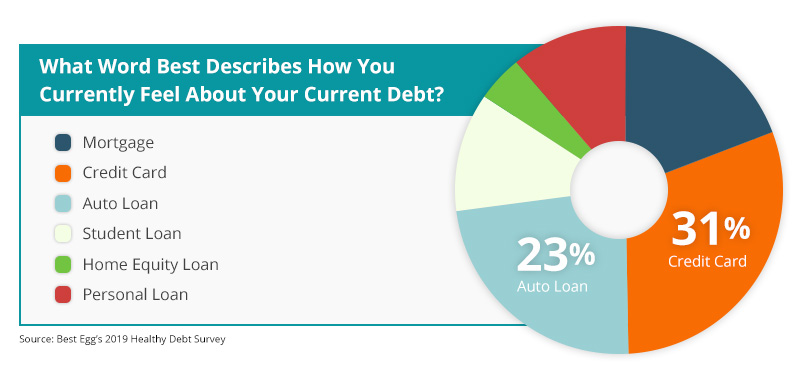

Car loans and credit cards are the most stressful debt.

While most respondents feel they have control of their debt, people with credit cards or auto loans reported they are more “Stressed Out” than respondents that carry any other type of debt.

Consumers generally know what unhealthy debt is, but still have it

We asked respondents to share what ‘unhealthy debt’ means to them.

Healthy debt, like a mortgage or student loans, is debt that you take on because the returns will eventually pay for the debt you’re in now. Unhealthy debt, like most credit card purchases, is debt that will not provide the same returns on investment. The top answers included: bills and overspending on credit cards, but also included mortgages, which we consider a ‘healthy’ debt.

And while Americans know that their debt may be unhealthy, 57.7% also believe their debt situation is better than their friends or family.

Our thoughts on Americans’ debt

While we are encouraged by how many Americans feel they can make ends meet, we believe these aggregate results point to larger issues that are facing consumers. People are stressed about debt. Some are feeling trapped, out of control, or like they can’t ever get out of it.

At the end of the day, everyone deserves the opportunity to feel good about their money and achieve their financial goals. But it’s clear that not everyone feels they can do that.

With our Best Egg personal loan platform, we have been a part of a solution to relieve that stress for more than 500,000 people. However, we recognize there is still a lot of work to be done.

This article is for educational purposes only and is not intended to provide financial, tax or legal advice. You should consult a professional for specific advice. Best Egg is not responsible for the information contained in third-party sites cited or hyperlinked in this article. Best Egg is not responsible for, and does not provide or endorse third party products, services or other third-party content.