About our loans

Find the type of loan that works best for you

Understand the difference between unsecured + secured personal loans and see which is a better fit for you

Our Unsecured Loans feature:

Loans up to $50,000 Fixed APRs † Loan terms from 3-5 years Top-rated personal loans

With our Secured Loans, you get:

Loans up to $100,000 Lower fixed APRs than unsecured†† Loan terms from 2-7 years Better approval odds than unsecured

Deciding between an unsecured or secured loan?

Learn more about different types of loans—secured and unsecured—so you can make your decision with confidence.

Read the article

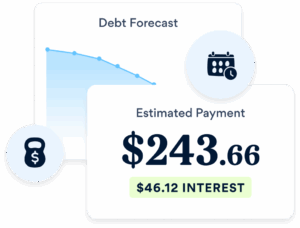

Estimate your monthly payments

See what you could be paying each month and what your personal loan interest rates might be before you apply.

Loan calculatorFAQ

A secured loan requires collateral (like a car or house), while an unsecured loan does not. Secured personal loans typically have lower interest rates but carry the risk of asset repossession if you default.

Secured loans usually offer lower interest rates because they are backed by collateral, reducing lender risk. Unsecured loans tend to have higher APRs since they rely on creditworthiness instead of assets.

Yes, most secured loans still require a credit check, but approval may be easier compared to unsecured loans. Some lenders offer bad credit secured loans if you have valuable collateral.

Both options work for debt consolidation, but secured loans may offer lower interest rates. However, unsecured loans avoid the risk of losing assets.

Secured loans are often easier to qualify for, even with low credit scores, since collateral reduces the lender’s risk. Unsecured loans require a good to excellent credit score for approval. Find out how to qualify for a personal loan in this article.

Explore our options

Personal Loan

Vehicle Equity Loan

Homeowner Discount