Fast-track your financial goals

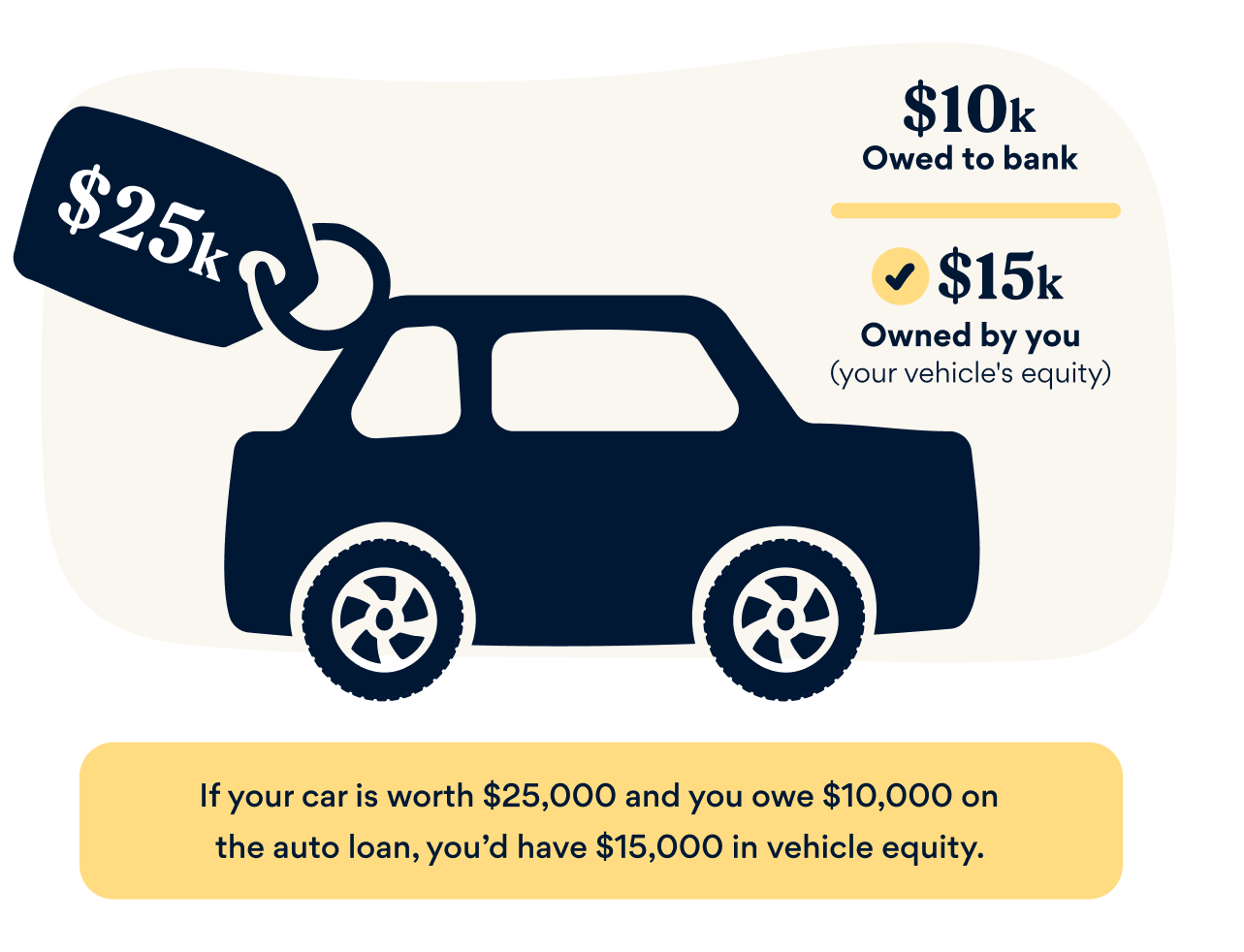

By leveraging your vehicle’s value, you unlock the potential to score lower rates and higher loan amounts than our unsecured personal loans.

Whether you own your car outright or are paying it off, a Best Egg Vehicle Equity Loan could quickly give you the money you need to consolidate debt, finance a major purchase, and more.

See if you qualify with no impact to your credit score

Predictable monthly payments with a fixed interest rate

More flexible approval standards than our unsecured personal loan offers

Access up to 250% of your vehicle’s value (max. $100,000)