Take a step toward financial confidence

We have the information and insights to help you take control of your financial health.

Get startedAttention

Now that the federal government’s forbearance, or pause, on repaying student loans has ended, we can help you stay on track with tools and resources to make the most of your budget.

Income-driven repayment plans can help make your federal student loan payments more affordable.

For up-to-date information, visit their webpage.

As a Best Egg customer, you have access to a free Best Egg Financial Health membership, which provides access to a full suite of financial tools and resources designed to help you better understand your finances.

As you prepare to make student loan payments again, here are some tools you might find helpful:

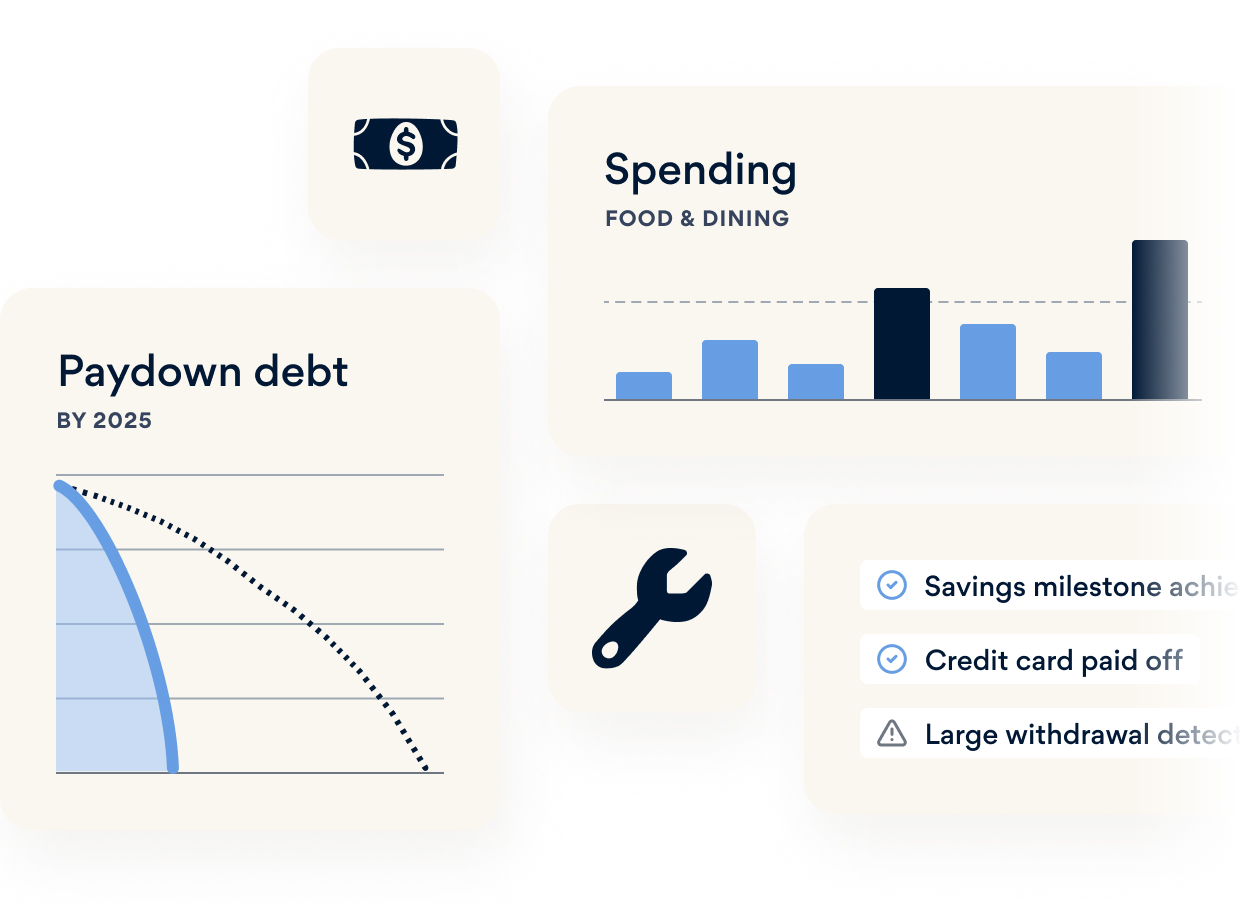

Money Manager—Create a personalized budget based on your spending

Debt Manager—View paydown strategies to help you manage your debt

Credit Manager—Stay on top of your credit and learn how your decisions can impact your score

Free to use

FAQ

It’s a period during which you can temporarily stop making payments on your student loan. This can be helpful if you’re experiencing financial hardship or other difficulties that make it challenging to keep up with your payments. During forbearance, interest continues to accrue on all loans.

Once the forbearance period ends, you’ll need to start making payments on your student loans again. Depending on the terms of your loans, that could mean paying hundreds of dollars per month.

If you’ve been used to not making these payments for the past few years, this could be a big shock to your budget. It’s important to prepare for this change by understanding exactly how much you’ll need to pay each month and adjusting your budget accordingly.

No, not at this time. For up-to-date information on the Federal government’s student loan repayment policies, visit their webpage .

Here are some tips for adjusting your budget to account for the end of student loan forbearance:

1. Review your loan terms: Make sure you understand exactly how much you’ll need to pay each month and when payments are due.

2. Re-evaluate your priorities: If your student loan payments are a significant expense, you may need to cut back on other areas of your budget. Be prepared to make some tough choices about where your money goes.

3. Consider refinancing: If you’re struggling to keep up with your student loan payments, refinancing may be an option. This can help you lower your monthly payments and potentially save money on interest over the life of your loans.

4. Look for ways to increase your income: If you’re currently working, consider asking for a raise or taking on additional work. If you’re not employed, now may be a good time to start looking for a job.

The end of student loan forbearance could significantly impact your monthly budget. By preparing for the change and adjusting as needed, you can help ensure you can make your student loan payments on time.

Missing payments and falling behind on your bills may impact your credit score. We have flexible payment options available, which could help minimize those impacts. Call us at 855-282-6353 to learn more.

Yes! We understand that adding a student loan payment to your monthly expenses could put a real strain on your finances. While it’s always best to keep making your Best Egg loan or credit card payments on time, we also offer flexible payment programs to help give your monthly budget some breathing room if you find yourself struggling to keep up with payments.

Our payment programs are straightforward and easy to understand, so you can focus on managing your budget without worrying about any surprises or hidden fees.

Depending on your specific situation, you may qualify for one of the following flexible payment programs:

To learn more, log in to your Best Egg account and click “Payments” in the main navigation. Then, click “Payment Assistance” to see your options.

We also partner with credit counseling agencies that may be able to simplify all your debts into one payment, cut your interest rate, and create a 3-5 year repayment plan for you. To directly connect with a credit counselor, call 866-889-9347.

Depending on your specific situation, you may qualify for:

Short-term Assistance Program: We’ll lower your interest rate and monthly payment for 6 months.

To learn more, call 833-707-1226.

We have the information and insights to help you take control of your financial health.

Get started