Resources

Financial Health

Your next step in financial progress

Explore tools and resources designed to help you understand your current financial picture so you may begin building a brighter financial future.

Already started? Log in now.

See your credit report and insights about your financial wellness

Get resources to help you take control of your financial future

No impact to your credit score

Securely manage it all in one place

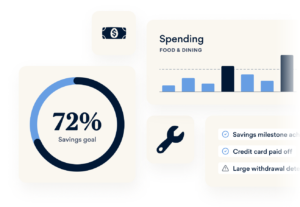

Take control of your finances, analyze spending, set a budget, develop goals, and track your progress.

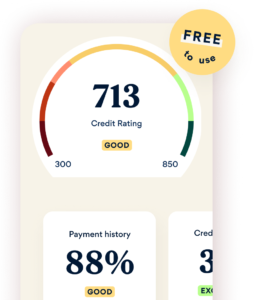

Monitor your credit anytime for free

Keep track of your credit score with a comprehensive credit report. Check it as often as you like with no impact to your score. Credit alerts keep you on top of activity that could affect your score.

Get startedFree to use

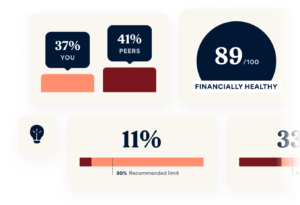

Understand the big picture

Discover your financial health score, debt to income ratio, get a snapshot of your credit utilization, and see how you stack up to your peers.

Knowledge is power

Explore our extensive library of articles to help you build on your financial understanding. You can also connect and discuss topics in our online, peer-to-peer community.

How it works

Understanding your financial health is just 3 steps away

Sign up for free

Activate your membership

Explore our suite of financial literacy tools

Free to use

FAQ

Best Egg Financial Health is a platform that empowers you to be in tune with your finances at all times. In addition to being the place you view your FICO® credit score, you’ll gain access to your VantageScore credit score, as well as in-depth insights into your overall financial wellness.

Some of the additional features you’ll enjoy with Best Egg Financial Health include:

- Alerts and notifications when there’s a change in your credit report

- A credit simulator designed to help you improve your credit score

- Financial calculators that give you a clear look into your financial situation

- New articles and resources tailored to your distinct needs

Working to improve your financial health is a lot like working to improve your credit score. Follow these tips and you’ll be improving your financial health in no time:

Make on-time payments: Your payment history is the single biggest factor in determining your credit score. Late payments can ding your score significantly, so focus on making on-time payments when working to improve your score.

Pay down credit card balances: It’s recommended that you keep your credit card balances below 30% of your credit limit. If you’re carrying high balances on your credit cards, try making more than the minimum monthly payment to pay them down.

Avoid opening multiple new accounts at the same time: FICO considers borrowers who open multiple accounts within a short timeframe to be riskier to lend to, which could lead to a decrease in credit score. For this reason, it’s wise to only open new accounts when necessary.

Keep unused credit card accounts open: Part of your credit score is determined by the average age of your credit accounts. The longer the average age, the better for your score – so it helps to keep older accounts open, even if you don’t use them regularly.

Diversify your credit mix: Lenders like to see that you have experience with different types of credit like revolving credit accounts and installment loans. While it’s not worth opening a new account just to improve your credit mix, it’s something to keep in mind when you’re working to improve your credit health.

Of course. As a company that functions solely online, the security of our customers’ information is of the utmost importance to us. The same level of protection you’ve enjoyed with Best Egg is present in our Financial Health experience.

Take a step toward financial confidence

We have the information and insights to help you take control of your financial health.

Get started