Applying for a Personal Loan

Once you decide that a personal loan is the solution for you, the next step is to apply for one. While the whole process of paying off debt may feel intimidating, applying for a personal loan has never been easier.

Personal loan eligibility will differ depending on the lender and whether you’re applying for secured or unsecured credit, but they will approve (or decline) your application based on similar requirements.

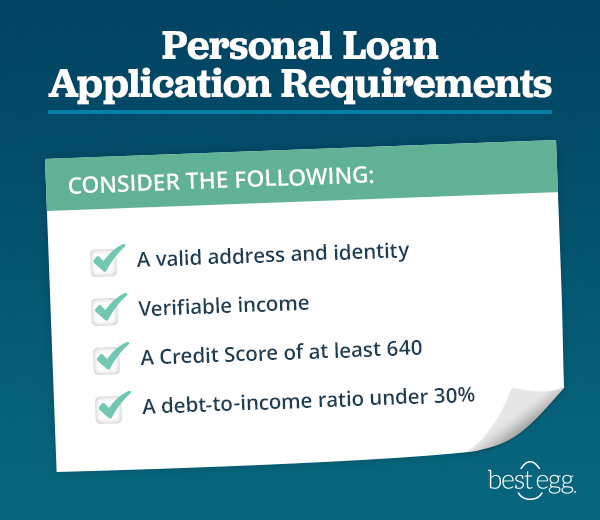

In addition to the information you can expect to fill out in any credit application—basic questions like your name, address and contact information—qualifying for a personal loan will typically require the following:

- A fair or good credit score: Good credit is one of the ways that helps you secure a personal loan. If your credit score is above 700, experts say you’re likely in a good place to qualify, and at attractive rates.

- A low debt-to-income ratio: Experts say that a good debt-to-income ratio is below 36%. But in general, the lower your debt-to-income ratio, the better the chance you have in securing a personal loan.

- A source of income: To pay back a loan, you’ve got to have a source of income. Creditors will ask for your source of income to make sure you can repay this debt compared to the income you’re earning.

If you’re in the market for a personal loan, take a few moments to access your credit report, calculate your DTI, and have a recent paystub or W2 handy.

If you’re curious about a Best Egg personal loan, check out our personal loan calculator to get an idea of what your monthly payments might look like.

How to Qualify for A Personal Loan

So, is it hard to qualify for a personal loan? Here are 4 tips to help you get prepared to qualify for a personal loan.

- Get a copy of your credit report: Staying up-to-date on your credit isn’t just important for your overall finances, it will help you figure out where to apply and how much you should ask for in your application. Also included in your credit report will be your credit score, which is often a key element in your application.

- Stay up-to-date with your payments: Your payment history is one of the most important factors in your credit score, which means it’s also an important factor in a personal loan application. If you have a history of making your payments on-time, you may be more qualified for a personal loan.

- Be mindful of your debt-to-income ratio: Your debt-to-income ratio is also an important factor when applying for a personal loan. A low debt-to-income ratio can increase your chances of qualifying.

- Keep that paycheck (or any proof of income) handy: You may not be asked to show any proof of income, but having it in hand will help you provide a more exact estimate of your gross income.

What Do I Need to Apply for A Personal Loan from Best Egg?

There are a ton of options out there when it comes to applying for a personal loan. We recommend that you consider your options before selecting any offer.

Here’s what you can expect if you apply for a Best Egg personal loan:

- We’ll ask a few questions in an online application to learn more about you and your finances.

- Once you submit an application, you’ll see what offers are available.

- If you qualify, you can select an offer (If you select an offer, your credit score may be impacted when we generate a hard inquiry on your credit report).

- After that, we may ask to verify your identity and the information you submitted in your original application. We may ask you to connect to your bank or submit documents to help us:

- Verify your identity and address

- Verify your income

- Verify a credit score of at least 640

- Evaluate your debt-to-income ratio

- Once verified, customers can expect money in their bank account within 1-3 days.

When you apply for a Best Egg loan, we want to let you know as soon as possible if you qualify. If you’re curious, you can check your rates at any time, and find out in minutes if you qualify for a personal loan from Best Egg (at no impact to your credit score).

Not quite ready to apply yet? Learn more about Best Egg personal loans or check out what our customers have to say to see what applying for a personal loan was like for them.

This article is for educational purposes only and is not intended to provide financial, tax or legal advice. You should consult a professional for specific advice. Best Egg is not responsible for the information contained in third-party sites cited or hyperlinked in this article. Best Egg is not responsible for, and does not provide or endorse third party products, services or other third-party content.