Calculate your debt-to-income ratio

Find out how much you could comfortably afford to borrow.

Understand more about how credit cards work, how to use credit cards responsibly, how to build credit with a credit card and even an explanation of credit card interest.

Find out how much you could comfortably afford to borrow.

See how affordable a new personal loan could be.

Keep an eye on your finances with this free suite of tools.

Take the confusion out of the different loan types.

Unlock free, easy-to-use tools created to help you reach your financial goals.

Get startedFAQ

A personal loan is a fixed-term loan that lets you borrow a lump sum of money and repay it in predictable monthly installments over a set period. Best Egg offers personal loans that can be used for a variety of purposes, including debt consolidation, home improvements, medical expenses, and more. The application process is quick and easy, and you can check your rate without impacting your credit score. Explore different personal loan options.

The primary difference between unsecured and secured loans lies in collateral.

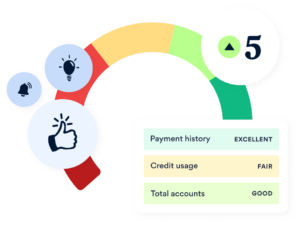

Improving your financial health involves understanding your financial situation and making informed decisions. Best Egg Financial Health is a free platform that provides tools to help you:

By using these tools, you can gain insights into your financial habits and make adjustments to improve your overall financial well-being.

Managing debt effectively involves understanding your obligations and creating a plan to pay them off. Best Egg offers resources to help you:

These tools can assist you in developing a personalized plan to reduce and manage your debt effectively.

Building a budget is the first step toward financial stability. With a simple budget, you can see where your money is going, cut your unnecessary expenses, and even find areas to build savings. Creating and sticking to a budget can be tricky. But Best Egg Financial Health a free tool called Money Manager, which can help you build a budget automatically.

Check out this resource article about the importance of building a budget and get tips for ways you can stick to a budget without sacrificing the fun.

Personal Loan

Vehicle Equity Loan

Home Secured