Money — it’s what pays for the things you need and want so you can live your best and most comfortable life. But having access to it isn’t always easy. Fortunately, there are financial tools out there that can help, like credit cards.

Credit cards are more than sleek pieces of plastic neatly tucked inside your wallet; They’re payment tools that help you purchase the things you need — when you need them most — with the flexibility of paying your balance back later.

You can use a credit card for just about anything — to buy things you want, earn rewards and points in exchange for spending, improve your credit rating, consolidate debt, and pay for emergency expenses.

How Do Credit Cards Work?

Before you start swiping plastic, it’s important to understand how credit cards work. With a revolving line of credit, a credit card gives you the flexibility to make purchases, transfer balances and withdraw cash that you can pay back — either in full or by making minimum monthly payments over time. Just remember, if you choose to carry a balance on the card, you could be hit with interest charges.

But, who’s in control here? You are. When used responsibly, a credit card could help you achieve progress when it comes to your credit. Creditors report information like payment history, debt usage, credit inquiries, and age of your credit accounts to three credit bureaus: Equifax, Experian, and Transunion. FICO and similar companies use the reported data to calculate your credit scores, which helps future lenders determine if you’re eligible for more credit. It’s worth noting that your credit scores can vary by credit bureau – these variances are due to differences in the algorithms they use and what factors they place the most weight on.

Types of Credit Cards

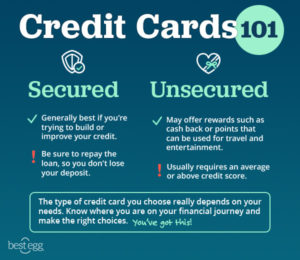

Which type of credit card is right for you? Let’s take a look.

Secured Cards

As the name implies, a secured credit card is backed by money you deposit with the lender to open an account. The amount of your deposit usually determines your credit line. For instance, if you deposit $500, you’ll have a $500 limit to spend at your discretion. If you manage your account with care and pay down the balance, you’ll get your deposit back and all of this positive activity will be reported to the credit bureaus.

Unsecured Cards

Unlike a secured credit card, an unsecured credit card doesn’t require a deposit to open an account. Instead, the lender assigns a credit limit based on their assessment of your credit risk. This could involve taking a look at your credit score, payment history, debt to income ratio and other indicators of your stability and ability to make payments.

Pro Tips:

- Secured cards are generally best if you’re trying to build or improve your credit, but be sure to repay the loan, so you don’t lose your deposit.

- Unsecured credit cards may offer rewards that can earn you cash back or points that can be used for things like travel and entertainment.

- The type credit card you choose really depends on your needs. Know where you are on your financial journey and make the right choices — you’ve got this!

4 Things You Should Know Before You Apply for a Card

A credit card is a great financial tool that could help you improve your credit score, save money on interest and rack up tons of perks and rewards — for travel, savings on future purchases and more.

Having a credit card in your wallet can bring great peace of mind and help simplify life. But, before you apply for one, there are a few things you should know.

Credit Card Payments

How Credit Card Payments Work

When you revolve a balance on a credit card, your credit card company will require you to make a minimum monthly payment or pay the balance in full by the due date that’s noted on your account. Generally speaking, you’ll have the flexibility to pay what you want, as long as you pay at least the minimum required by the due date.

How Minimum Payments Are Calculated

The minimum payment is generally set at either a fixed amount, like $25, or a percentage of your balance, like 1% or 2% — whichever is higher.

Pro Tips:

- Pay off debt sooner than later by paying more than your minimum monthly payment.

- Stay on top of your minimum payments. Missing a payment or paying less than the amount due could cause you to lose promotional rates, be charged a late fee, and be reported past due to the credit bureaus. Staying on top of your payments could help you build or maintain good credit.

Know Your Limits

What Is A Credit Card Limit?

Assigned by your financial services company, a credit card limit is the maximum amount of credit that you have access to through your credit card.

What Does Available Credit Mean?

The available credit is the amount you have left on your credit line to spend. In simple terms, it’s your credit line minus the balance you owe.

Pro Tips:

- Know your limits: Going over your credit limit could have a negative impact to your credit score and on your opportunity for credit line increases.

- Good payment habits may come with perks: Credit card issuers periodically review accounts, and those in good standing may qualify for proactive credit line increases — so making more than your minimum payment could help you qualify for this benefit.

Credit Card Balances

What Is a Credit Card Balance?

A credit card balance reflects the total amount you spend, including any fees and interest charges on your account. It may also be used to calculate your monthly payments.

Pro Tip:

- Keep your balances low: It’s one of the easiest ways to improve your credit score since part of your score is influenced by your credit utilization ratio, which is the percentage of how much you owe on your card vs. your credit limit.

Credit Card Fees

Some credit cards have fees and others don’t. The good thing is that many fees are avoidable if you know what they are, and why they’re charged.

Annual Fee:

Not all cards come with annual fees but the ones that do may offer rewards and benefits that outweigh the cost of the fee. Do the math to determine if what you’ll get in return is worth it.

Balance Transfer Fee:

Balance transfer fees can run anywhere between 3% and 5% of the amount you transfer. Many cards offer low-interest rates on balance transfers for a period of time. The fee could be worth it if what you save in interest makes up for the cost of the fee.

Cash Advance Fee:

When you borrow cash from a credit card, expect to pay a fee of 2% to 5% of what you borrow. Also consider ATM fees and the interest rate charged on cash advances since it may come with a higher cost.

Finance Charge:

Finance charges vary from card to card. What’s important to remember is that you can avoid finance charges by paying your balance in full by the due date each month.

Foreign Transaction Fee:

A foreign transaction fee is a charge of 1% to 3% added onto purchases that you make outside the U.S. Be on the lookout for this fee — some cards like travel cards don’t charge it.

Late Fee:

Late fees vary from card to card. Avoiding this fee is easy if you make at least your minimum payment by the due date each month.

Over-limit Fee:

If you go over your credit limit you could be charged an over-limit fee. The simplest way to avoid this fee is to stay well under your credit limit.

Returned Payment Fee:

A returned payment fee is charged when your payment is returned for insufficient funds. The best way to avoid this fee is to make sure you have enough money in your account to cover your payment.

How to Start Using A Credit Card

If you’re thinking about using a credit card, be smart about it. A credit card can help you achieve many goals in life with convenience. And, when handled responsibility, a credit card could help you build credit and open doors to achieving future financial success.

Not sure if a credit card is the right financial tool for you? Our article “Personal Loans vs. Credit Cards” could help you choose the right financial solution.

This article is for educational purposes only and is not intended to provide financial, tax or legal advice. You should consult a professional for specific advice. Best Egg is not responsible for the information contained in third-party sites cited or hyperlinked in this article. Best Egg is not responsible for, and does not provide or endorse third party products, services or other third-party content.