You’re likely aware that having a strong credit score is a key step in achieving your financial goals, but do you know the reasons why? Besides helping you get approved for a mortgage, buy a car, or open a credit card, high credit scores can also give you access to financial perks like lower interest rates, which can make your debt-paying journey much cheaper and maybe even a little bit faster. Let’s start this off by examining how lenders use your credit score to determine what type of interest rates you’re eligible for.

How Lenders Use Credit Scores

Your credit score essentially gives lenders an idea of your credit risk, or the likelihood that you’ll be able to make required payments. They then use your suspected risk level to determine if you’re a good candidate for a loan or a line of credit.

Credit scores typically range from 300 to 850, and the higher your score is, the more likely lenders are to believe that you’ll be able to repay your debts on time. Because lenders consider people with high credit scores to be low-risk customers, they’re more likely to offer perks like lower interest rates or higher loan amounts on their products. As you might expect, the opposite goes for those with lower credit scores, which is why they tend to have higher interest rates on the money they borrow.

A score of 700 or higher is generally considered to be a good credit score, and it’s a great place to set your sights if you’re in the process of building or rebuilding your credit.

Can Lower Interest Rates Really Save You Money?

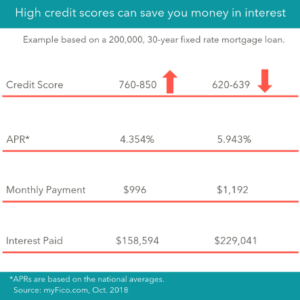

Lower interest rates can save you a lot of money, especially if you’re making interest payments on a long-term loan. To illustrate our point, let’s take a look at how much money a high credit score can save you on a 30-year fixed-rate mortgage loan.

You’ll notice that the APRs (or interest charged on a yearly basis) for strong and weaker credit scores only vary a bit more than 1.5%, yet the savings over a 30-year period are immense. A $70,000 discount on a home for having a good credit score? Count us in!

Though getting your credit score in the 760-850 range can be difficult, it’s far from impossible.

Now that you have an idea of how much money you can save with a high credit score, we’ll explain the variety of factors that determine your credit score.

What Factors Influence My Credit Score?

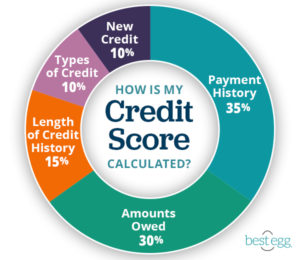

Several factors determine your credit score, and each factor has a varying amount of influence on your overall score.

As you can see from the graphic, your payment history determines your credit score to the greatest extent because lenders want to know if you’ve paid back past debts in a timely fashion. For similar reasons, the amount of money you owe to debtors significantly influences your score as well – lenders are (understandably) averse to loaning money to people with high amounts of debt out of concern that the borrower will be unable to pay them back.

With the bit of background we provided on these two factors, you can probably assume why the length of your credit history, your credit mix, and your new credit inquiries play a much smaller role in shaping your overall credit score. While they’re still incredibly important, think about it this way: If you were considering loaning a friend money, you’d want to know if they have a history of paying people back and the amount they owe to others before giving them your hard-earned funds. The same line of thinking generally applies for lenders.

If you’re interested in taking out a loan but concerned about the state of your credit score, this next section is for you – here we’ll share the minimum credit scores required for different types of loans so you can make the best financial decisions based on your unique situation.

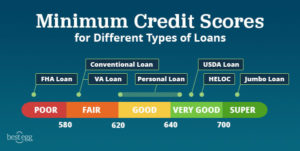

Minimum FICO Credit Score Generally Required for Different Types of Loans

FHA Loan:

- Ideal for people who have lower credit scores or little cash for a down payment.

- Approximate credit score required: 580

Conventional Loan:

- A popular mortgage loan option for people with good credit.

- Minimum credit score required: 620

VA Loan:

- A mortgage program offered to veterans and active service members, with zero down payment.

- Approximate credit score required: 620

Unsecured Personal Loan:

- A type of installment loan that requires no collateral and can be used for a variety of purposes, from debt consolidation and home improvement all the way to medical expenses.

- Approximate credit score required: 620 – 660+

USDA Loan:

- Offered to low-income borrowers who are looking to buy a home in a designated rural area.

- Approximate credit score required: 640

Home Equity Line of Credit:

- A loan that allows you to borrow against the equity in your home and use the funds for home improvement, debt consolidation, or other major expenses.

- Approximate credit score required: 680

Jumbo Loan:

- Designed for people who wish to purchase a home that costs more than traditional loan limits.

- Approximate credit score required: 700

If your credit score is below 580, there’s no two ways about it – you’re going to have a tough time qualifying for most credit cards and loans. While you’ll have to put some work in, building or rebuilding your credit is possible, and our article 6 Tips for Building Your Credit is just the place to start.

This article is for educational purposes only and is not intended to provide financial, tax or legal advice. You should consult a professional for specific advice. Best Egg is not responsible for the information contained in third-party sites cited or hyperlinked in this article. Best Egg is not responsible for, and does not provide or endorse third party products, services or other third-party content.