That moment when you realize you’re in over your head with debt? It can be an emotional process.

Debt can be overwhelming, you may feel like your head is below the water, or you may just have realized you’re not making the progress you’d hoped you’d be making.

Managing Debt

Struggling to manage debt is more common than you think. The good news is that there are a ton of ways to better manage your debt. Looking for ways to make your finances add up again? First, recognize the signs.

7 Signs You’re Struggling to Manage Debt

Ask yourself: do you worry about your money every day? Do you dread looking at your accounts knowing that your money isn’t going where you want it to go?

Here are 7 signals that your debt is getting in the way of your financial goals:

- You’ve repeatedly made late payments on monthly bills.

- Your credit card balances are maxed out or keep rising each month.

- You’ve drained your savings or you’re having trouble saving.

- Your credit score is slipping.

- You’re getting denied for new credit when you apply.

- Your debt-to-income ratio is high and climbing.

- You’re bouncing checks or overdrawing your bank accounts.

Ways to Manage Your Debt

The first step to start managing your debt is to acknowledge that you’re over-extended. So, congrats on getting here! Really. A lot of people don’t realize their situation until it’s too late and your options are severely limited (More on that in a few).

Taking your debt head on requires some dedication, but with the right approach and plans, you can better manage your debt faster (and potentially save money).

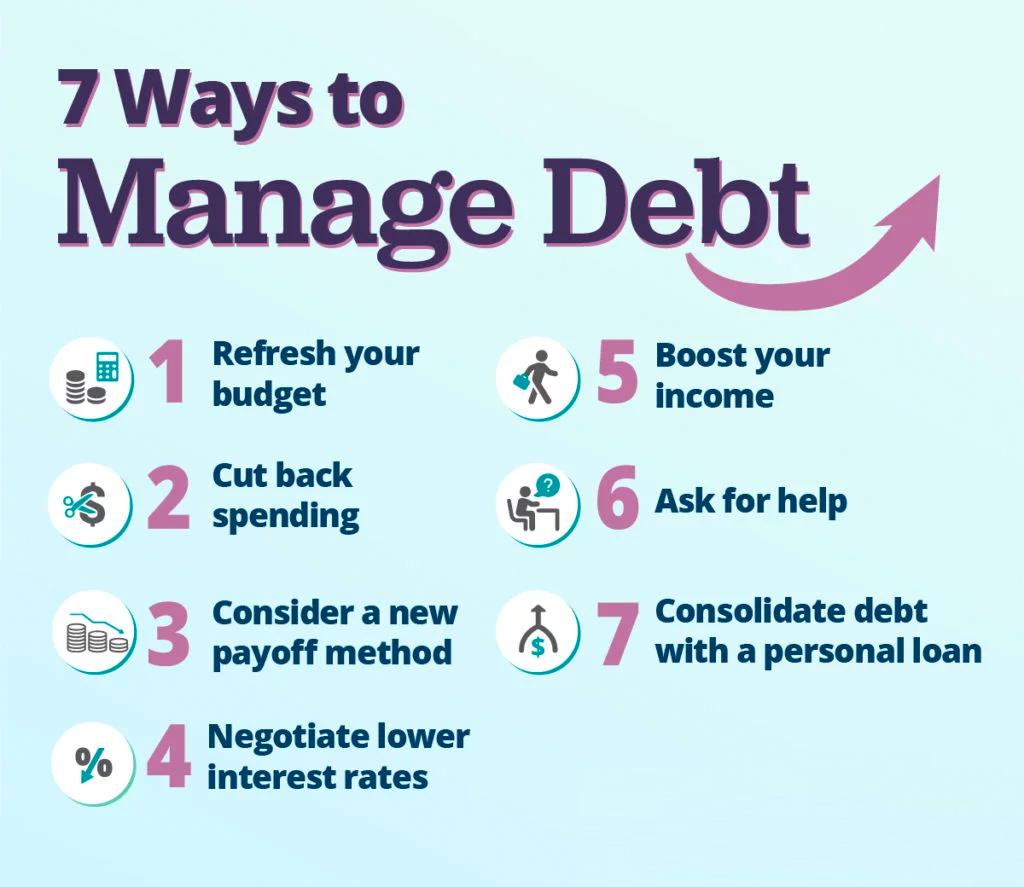

Here are 7 ways to better manage your debt:

- Refresh or create a new budget: We often lose track of our budget when our lifestyles or expenses change. Take some time to revisit your budget and make sure it reflects what your income and expenses look like. Knowing your true financial picture will help you understand what actions you should take to manage your debt better.

- Get a handle on extra spending and credit cards: Overspending with credit cards is easy to do because you often have credit lines that allow you to spend more than what you have in your bank account. Take a look at your credit card statements. Are there expenses you made that weren’t in your budget? Are you paying for 5 different streaming services when you really only use 2? When you curb extra expenses, you’re making sure you’re not adding unnecessary debt on, while staying focused on reducing the debt you have.

- Consider a new debt payoff method: Depending on your finances, there are a few methods people use to help them pay off debt. Two of the most common are the debt-avalanche and the debt-snowball methods. When you avalanche your debt, you pay off the highest-interest balances first. When you snowball your debt, you pay off your lowest balances first (no matter the interest rate), then pay off your next smallest debt, before you finally pay off your largest balance.These methods work for people who are able to pay more than just their minimum monthly payments on their bills, so they may not work for everyone. Adopting a debt payoff method can keep you focused on your goal and allows you to easily see progress milestones.

- Contact your creditors to see what options are available: Call your credit card and loan companies to see if they have alternative payment options available.

- Think about ways to add to your income: Consider taking on a side job like driving for a ride-share or food-delivery company (such as Uber or Grubhub), turning your hobby into a business on Etsy or BigCartel, pet-sitting, tutoring, or taking on a seasonal part-time job. By adding more income into your budget, you can make more room to pay off bills and manage your debt faster.

- Know when to ask for help: Sometimes no amount of budget-wrestling or cutting back expenses will help. There are options out there if you truly are stuck and can’t make your way out by yourself. Declaring bankruptcy and debt management companies can help to reduce some debts you may have, but they come with fees and the potential for negative credit score impacts. A word of caution, there are a lot of debt relief scams out there, so it is important to do your research if you’re considering this option.

- Consolidate debt with a personal loan: When you consolidate debt, you pay off higher-interest balances with a personal loan. Then you pay off the single personal loan at a more manageable monthly payment and a set repayment schedule. Debt consolidation can help you pay it off faster and potentially save money.

Full disclosure: Best Egg offers personal loans for debt consolidation. We’re sharing it as an option because we know just how powerful consolidating debt into a personal loan can be in helping people pay off their debt. More than 600,000 people have trusted Best Egg to help them make financial progress. Take a look at our reviews to learn more about personal loans have helped people manage their debt.

How A Debt Consolidation Loan May Help You Manage Your Debt

A debt consolidation loan may help you manage debt by offering:

- Lower fixed interest rates that help you save money.

- One fixed monthly payment— you’ll consolidate all of your balances and bills into one.

- An established timeline for repayment so you know exactly when your loan will be paid off.

- Access to dedicated loan specialists who want to help should you ever have questions or need assistance.

Visit Best Egg’s debt consolidation page to find out if a consolidation loan is right for you.

This article is for educational purposes only and is not intended to provide financial, tax or legal advice. You should consult a professional for specific advice. Best Egg is not responsible for the information contained in third-party sites cited or hyperlinked in this article. Best Egg is not responsible for, and does not provide or endorse third party products, services or other third-party content.